You can easily generate Proforma/Draft Invoices for your B2B/B2C sales will auto-filled billing details and particulars with ready-to-share Email and PDFs.

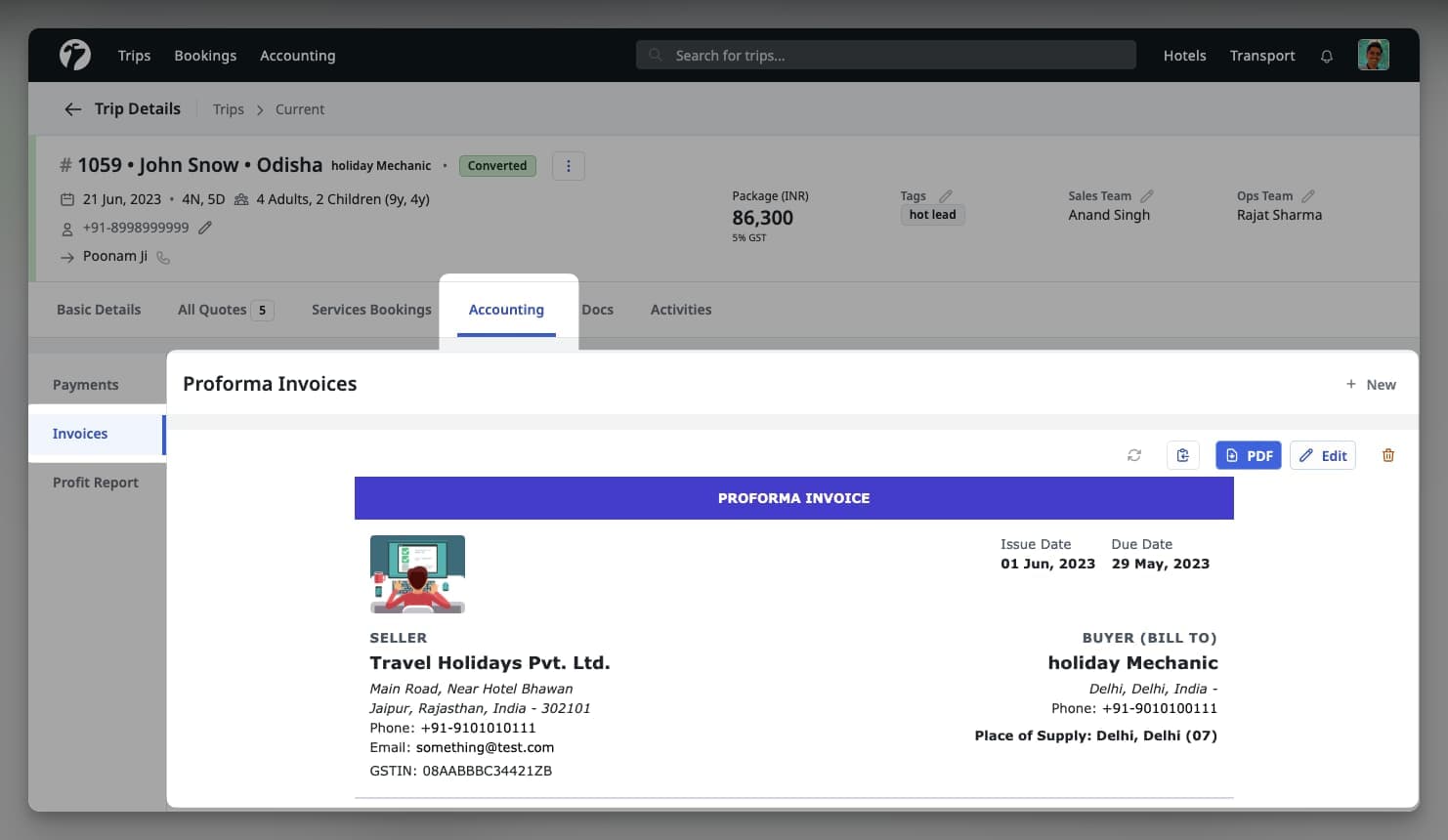

To view your Proforma Invoice(s) for a Trip, visit the Accounting > Invoices Tab from the Trip’s Detailed page.

Create Proforma Invoice

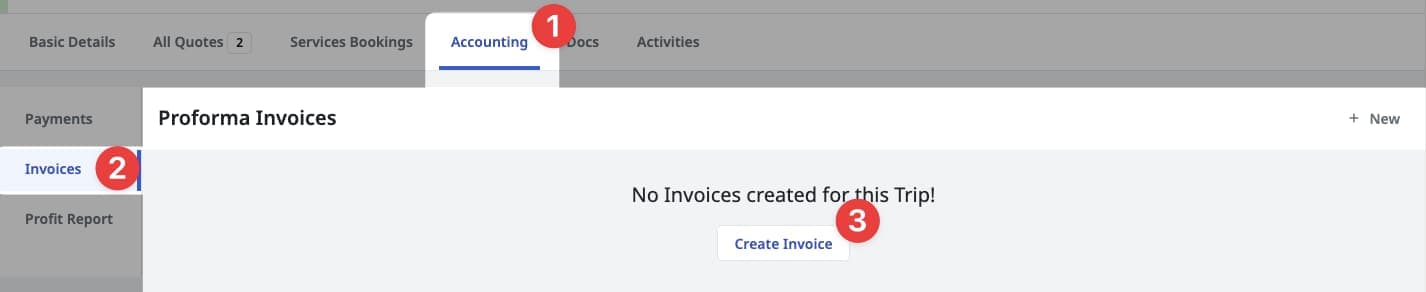

To create a Proforma Invoice for a Trip, visit the Accounting > Invoices Tab from its detailed page.

This will initiate the invoice creation flow.

Billing Addresses

In the top header section of creation flow, you will see seller’s (your) and buyer’s (B2C/B2B) billing addresses along with billing details.

Seller (Your) Billing Details

Invoices will automatically use the Destination-wise billing addresses from your Oganization’s Settings page. To update any info in your billing details, please update them in from Organization > Settings from the Billing Addresses section. Checkout the product documentation for more details.

Destination-wise and Primary Addresses

Invoices will use destination-wise billing address and fallback to your primary billing address if not specified. When updating your billing address details, please make sure you are updating the correct address.

Buyer (B2B/B2C) Billing Details

Software will automatically pick the billing details from the B2B (Trip Sources) and B2C (Guests) if you have updated the same in source details. You can also update the buyer’s billing details directly from the Invoice creation/updation flow.

Place of Supply

In most of the cases, place of supply will determine the type of taxation applicable in your sales. The place of supply should be according to the provided services and your accounting rules. Please consult with your accounts team and government rules to ensure proper place of supply is selected for your sales.

Particulars

All services and their taxation details must be provided with a proper description of every item. Using the taxation details from the quotation, system will auto-fill the particulars and taxation details. You MUST verify and ensure that these details are as per your accounting and government rules.

Liability and Correctness

Software will help in auto-filling the details of particulars and taxation but these details might be incorrect or may not follow local accounting or government rules. Hence, these details MUST be verified and corrected by the Invoice issuer before issuing any invoice.

Terms and Special Notes

You can also include (optional) any special notes and terms applicable for a particular invoice.

Payment Details

Proforma Invoices will automatically use the bank accounts details from your Organization’s setting page. You should add bank account details if you want the software to automatically include these details in generated invoices. Checkout the Bank Accounts documentation for more details.

Sharing Invoice

You can share invoices via Email or you can download the PDF which is automatically generated for all your invoices. To share the Invoice via Email, click on Copy icon which will copy the Invoice as Email. Simply paste the content in your Email composer and it is ready to be shared.

You can also download the Invoice as PDF and share a copy as per your requirements.

Update Proforma Invoice

You can update the details of a Proforma Invoice in the same way you create an Invoice. To update, visit the Invoice’s detailed page and click on Edit icon, right next to the Copy button.