This release introduces 2 new quotation pricing strategies Per-Component (PC) and Per-Component Per-Person (PCPP) in addition to the 2 existing pricing strategies (Overall and Per-Person (PP)). We have also introduced enhanced pricing and taxation flexibility with markup and tax controls at the component level (hotels, transport, activities, extras). Taxes and Markup can now be applied either on Cost + Markup or on only Markup, with component-specific rates. In addition to this, new quotations now support specifying tax on flights and rounding-off flight prices as well.

Let’s go through this update in detail.

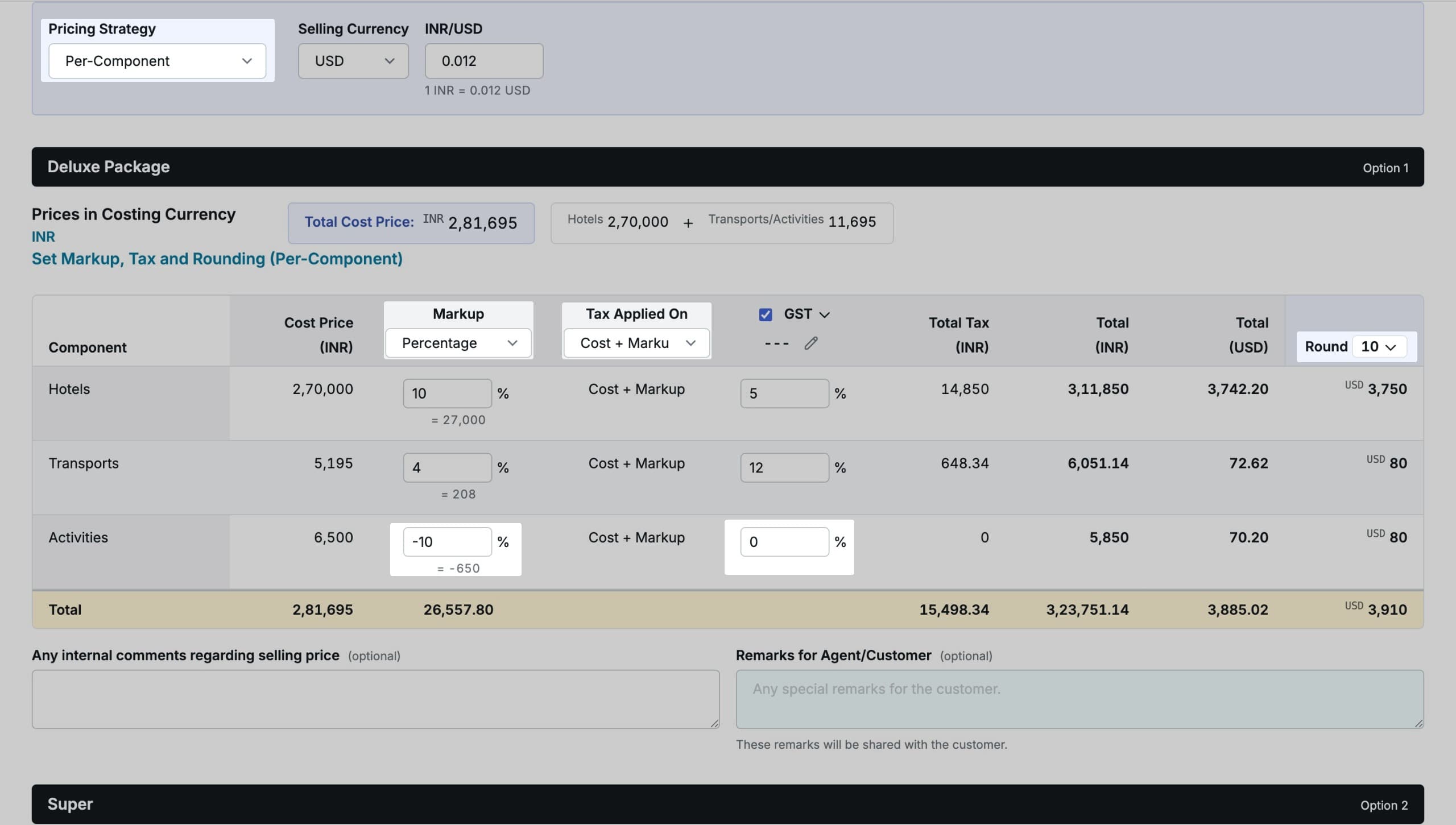

1. Per-Component Markup and Taxation (PC)

BETA Feature

This new feature requires explicit consent from you to enable it for your account. Please contact our support team (via email or our WhatsApp group) to request this update for your account.

Earlier to this new update, you could only specify markup on the total cost price of the quote or in the per-person component cost price. To apply markups on specific component level (e.g. Hotels, Transfer/Tickets), you would typically add markups to individual stay-nights/services or add the markup into the contract sheets to ensure correct final quotation price as per your specific needs.

With this update, you can now mention the markup with each component of quotation (e.g. hotels, transport, activities) to have its own markup and tax, instead of applying it on the total cost price. After applying the markup/tax, the selling price of each component can be rounded off (for simplicity and consistency). This ensures better control over pricing, and makes it easier to track profitability per component.

Only use if Required

This is NOT a mandatary way to apply markup and taxation. You can keep using existing markup and taxation strategies if you don’t require these new ways of quote costing. However, we do recommand these strategies to be used instead of manually adding markups to individual services prices.

Use Cases

Below are some use cases where you would want to apply these new strategies with the output of each use case.

1.1 – Apply markup and tax per component with rounding

Input: Hotel ₹10,000 (markup 10%, tax 12%), Cab ₹2,000 (markup 5%, tax 18%), Rounding 5

Expected Output:

- Hotel - Markup ₹1,000, Tax ₹1,320 - Hotel selling price ₹12,320 (rounded)

- Cab - Markup ₹100, Tax ₹378 - Total ₹2,478 (unrounded) - Cab selling price ₹2,480 (rounded)

- Total price = ₹14,800

1.2 – Apply tax on only markup for some components without rounding

Input: Hotel ₹10,000 (markup 10%, tax 12% on only markup), Cab ₹2,000 (markup 5%, tax 18%), No Rounding

Expected Output:

- Hotel - Markup ₹1,000, Tax ₹120 - Hotel selling price ₹11,120

- Cab - Markup ₹100, Tax ₹378 - Cab ₹2,478 (unrounded)

- Total price = ₹13,598

1.3 – Discount on some components

Input: Hotel ₹10,000 (markup 10%, tax 12% on only markup), Cab ₹2,000 (markup ₹-500, tax 18%), Rounding 5

Expected Output:

- Hotel - Markup ₹1,000, Tax ₹120 - Hotel selling price ₹11,120 (rounded)

- Cab - Markup ₹-500, Tax ₹270 - Cab selling price ₹1,770 (rounded)

- Total price = ₹12,890

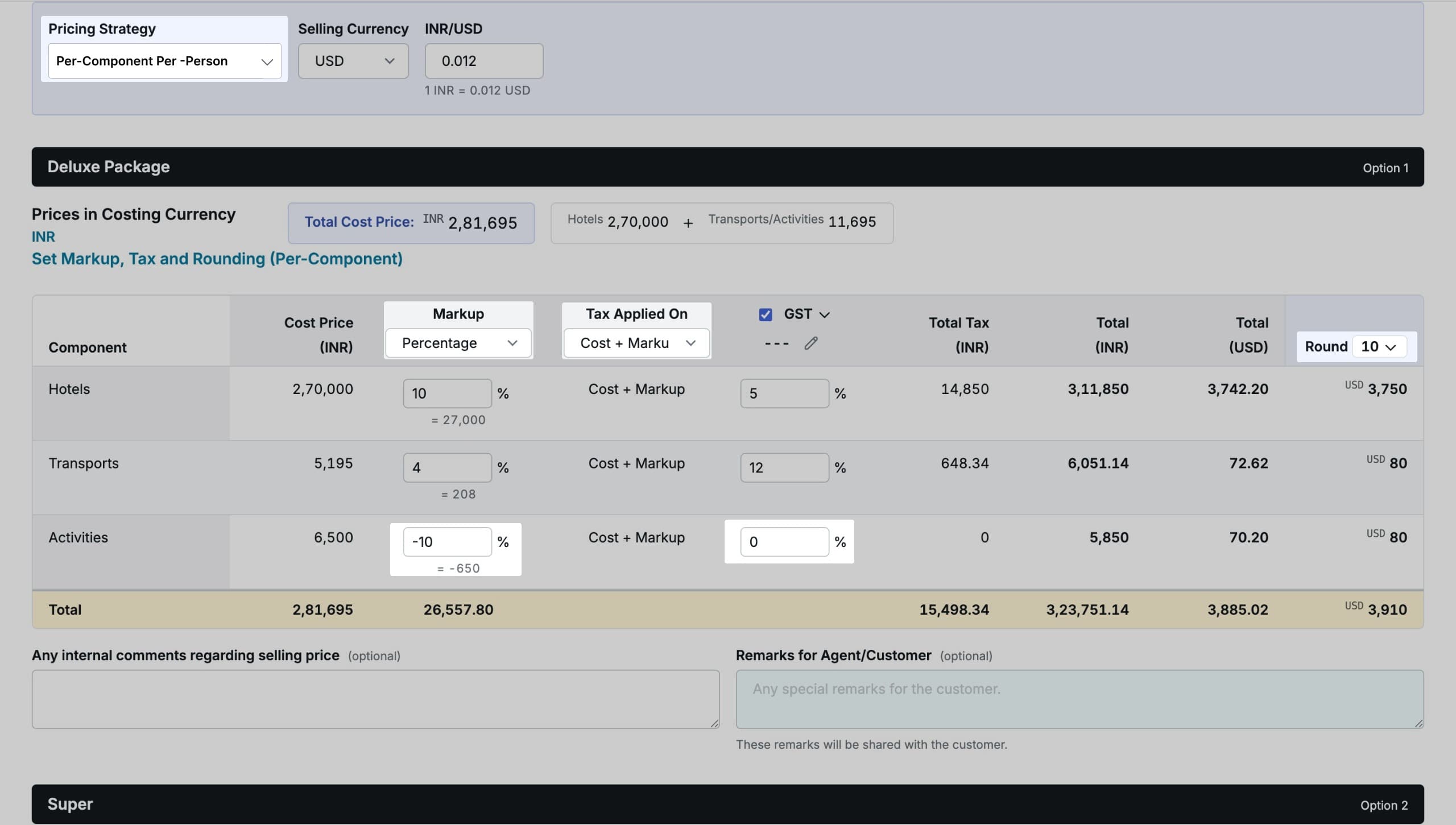

2. Per-Component Per-Person (PC-PP)

This pricing strategy behaves similar to Per-Component except you want to share prices on a per-person basis but do the markup and taxation in per-component basis. This is helpful in situations where you want to control the markup and tax for each component separately, but also want to share the final prices on a per-person basis.

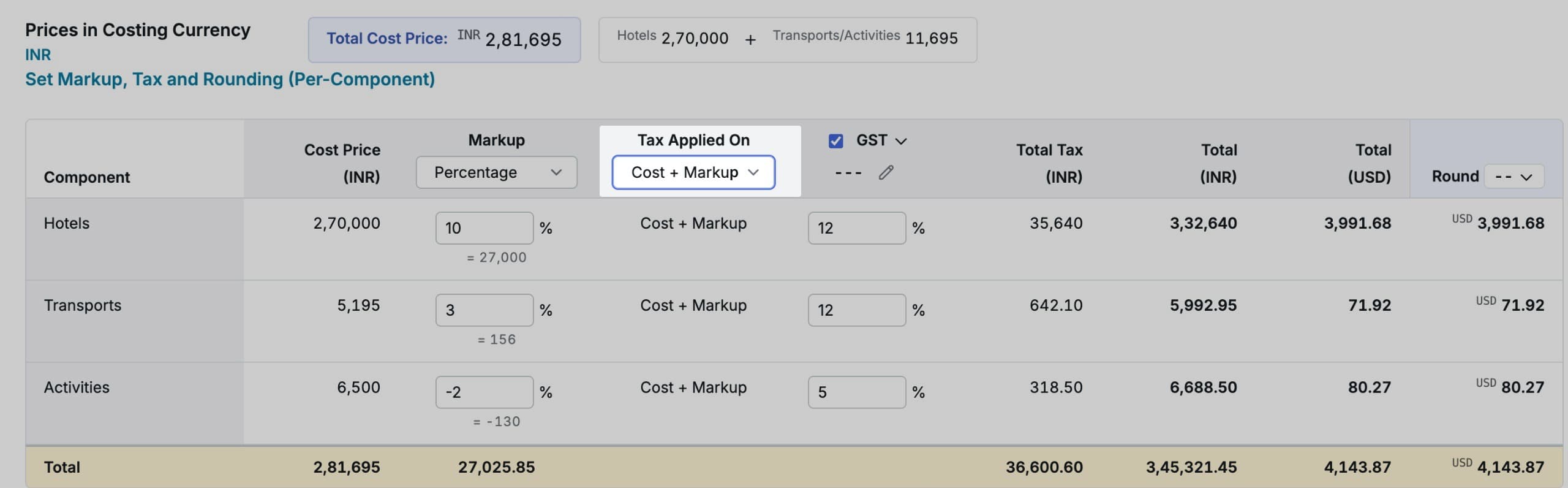

3. Advanced Taxation

This new update introduces a new taxation strategy on the basis of amount where you would want to apply the tax. These taxation strategies are available when using Component-Wise Markup strategies.

3.1: Tax on Cost + Markup

This is the existing strategy where the total tax is applied on Total Quote Cost + Markup. If you want to keep using it, no changes are required in your existing flow. Under the Tax Applied On dropdown, you should see Cost + Markup when using this taxation strategy. This is the default strategy for all new quotes. When using Component Wise Markup strategy, you can apply this strategy on specific components. This is also the only strategy available when NOT using Component Wise Markup strategy.

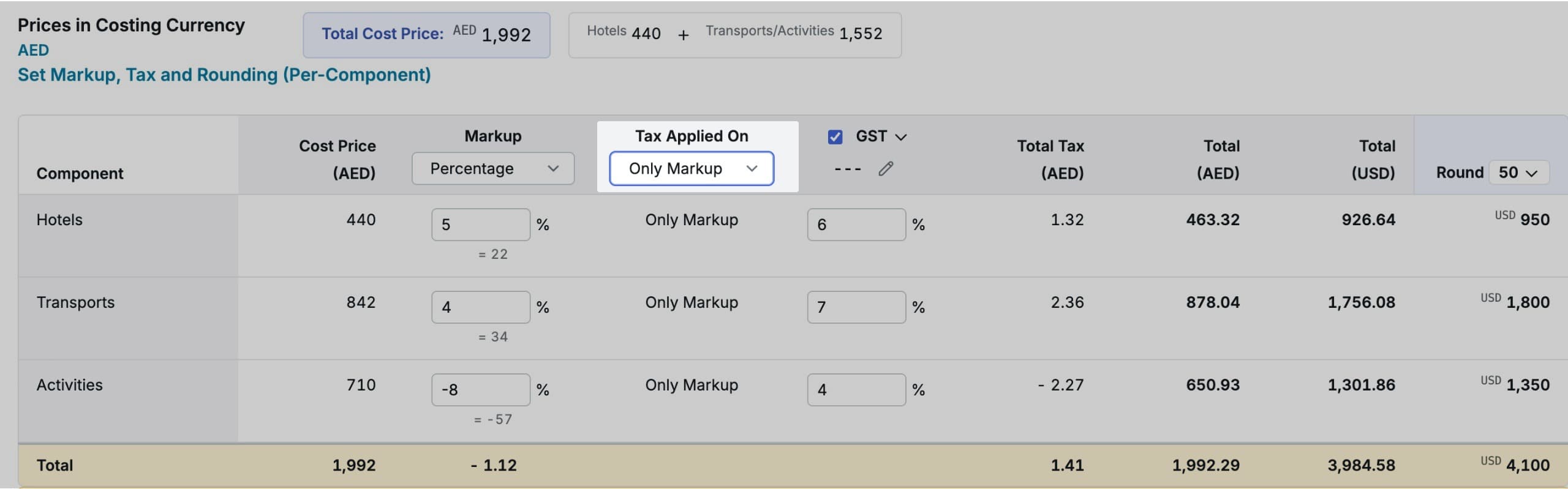

3.2: Tax only on Markup

This is the new strategy in which the tax is only applied on Total Markup. Under the taxation dropdown, you can select the Only Markup option. Tax on “Only Markup” means the tax is applied just on the profit portion, not the base cost. “Only Markup” option could be helpful in situations where your base cost already includes tax and you want to add your own markup with tax. Additionally, component-specific tax rates allow different tax percentages for different parts of the product or service, depending on regulations or cost structure. This enhances control, accuracy, and compliance in tax calculations. Please note that this strategy is only available when using Component Wise Markup strategy.

Use cases

Let’s explore some of the use cases and their outcome when using different taxation strategies.

3.1 – Tax on Cost + Markup

Input: Base Cost ₹10,000, Markup 20%, Tax 10% Output: Markup ₹2,000, Tax ₹1,200 (10% on ₹12,000), selling price = ₹13,200

3.2 – Tax on Only Markup

Input: Base Cost ₹10,000, Markup 20%, Tax 10% Output: Markup ₹2,000, Tax ₹200 (10% on ₹2,000), selling price = ₹12,200

3.3 – Tax on Cost + Markup for Negative Markup

Input: Base Cost ₹10,000, Markup -20%, Tax 10% Output: Markup ₹-2,000, Tax ₹800 (10% on ₹8000), selling price = ₹8,800

3.4 – Tax on Only Markup for Negative Markup

Input: Base Cost ₹10,000, Markup -20%, Tax 10% Output: Markup ₹-2,000, Tax ₹0 (No tax applied on loss), selling price = ₹8,000

Edge Cases

When applying markup and taxation, please note the following edge cases.

- Negative markup + tax on Only Markup: During this case, the tax will be 0 because no tax is paid on discounts

4. Flight Pricing Rounding Consistency

Flights selling prices will now also be rounded-off if price rounding is enabled. Additionally you can choose to apply tax on flights as well.

5. Rounding behavior changes

Earlier, in Overall pricing strategy, rounding was applied on cost price + markup + taxes + flights. This ensured that the total price is perfectly rounded but when sharing prices without flights, the prices was not rounded. With this new update, the rounding is applied separately on cost price + markup + taxes and flights. After the rounding of these components, the total price is calculated by adding both these rounded prices, resulting in final rounded package price. Because of this, you may notice a slight increase in the final price if you try to edit a previous quotation (with overall pricing strategy) when rounding is enabled.

6. Component wise breakup sharing during Multi-Option Quotes

Earlier to this version, when creating multiple quote options (3 Star, 4 Star, 5 Star), you were not able to share component-wise price bifurcation due to markup distribution issues as the markup was not applied to individual components. With this new update, if you use the Component-Wise Markup strategy, you can now share the component-wise price bifurcation even when using multiple quote options.

Requires Component-Wise Markup costing

Please note that you must use the Component-Wise Markup to be able to share the price bifurcation. In other costing strategies (Overall markup and overall-per-person markup), the component wise breakup sharing is still not possible.

7. Other Improvements

- We have updated the name of word button to excel in Profit report.

- Downloading an incomplete Trip Profit report now requires explicit content to ensure that the trip’s profit report is complete before download, ensuring proper bookings status updates by all team members.